The Main Principles Of How Does Medigap Works

Table of ContentsThe Single Strategy To Use For MedigapLittle Known Facts About What Is Medigap.The Best Strategy To Use For What Is MedigapThe Basic Principles Of Medigap Benefits 7 Simple Techniques For Medigap

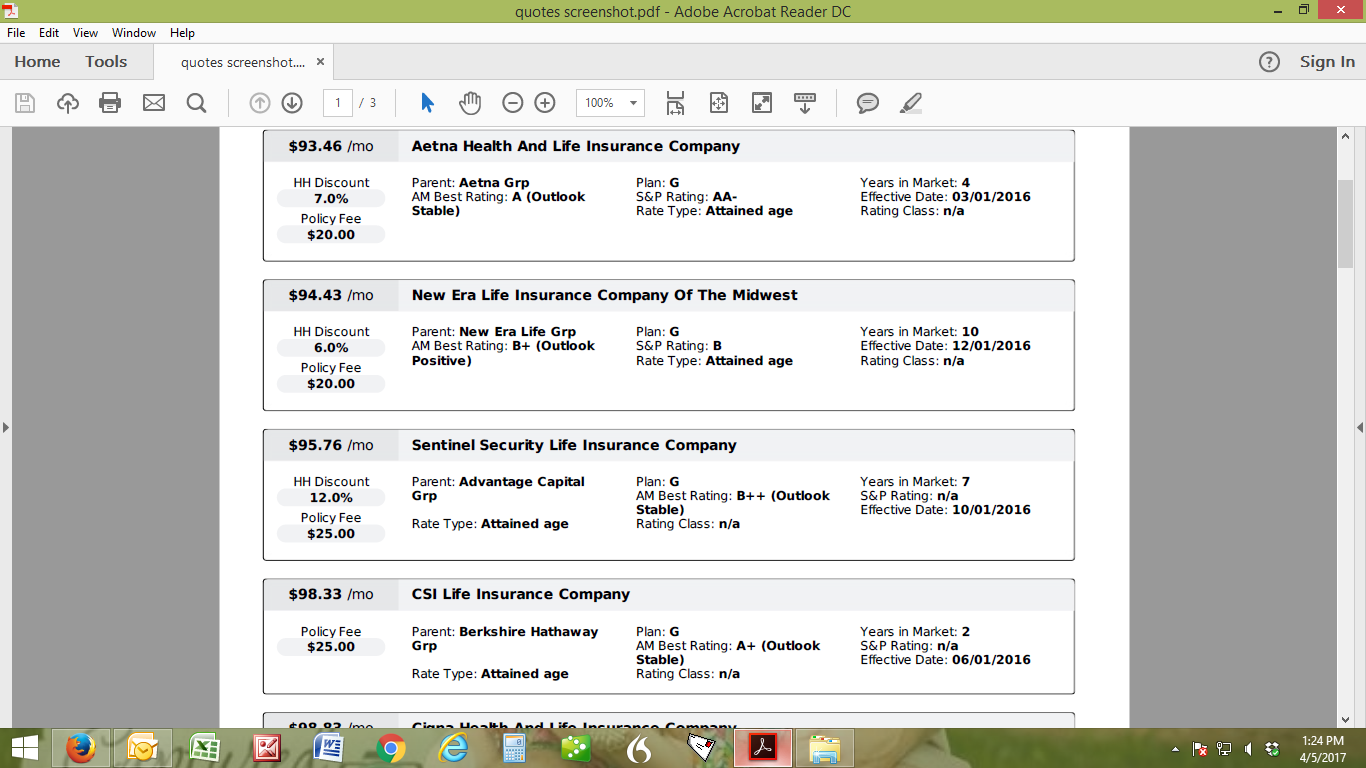

You will certainly require to talk with a licensed Medicare agent for prices and also availability. It is highly recommended that you purchase a Medigap policy during your six-month Medigap open enrollment period which begins the month you turn 65 and also are registered in Medicare Part B (Medical Insurance) - What is Medigap. During that time, you can acquire any type of Medigap plan offered in your state, even if you have pre-existing problems.You could need to purchase an extra expensive policy later, or you could not have the ability to get a Medigap policy whatsoever. There is no guarantee an insurer will market you Medigap if you make an application for insurance coverage outside your open registration period. Once you have actually determined which Medigap plan fulfills your demands, it's time to learn which insurer sell Medigap policies in your state.

The precise insurance coverages depend on the kind of plan that is acquired and also which state you live in.

In general, Medigap insurance companies deal with Original Medicare as well as each plan type uses the very same advantages, even across insurance companies. In most states, Medicare supplement strategies are called A with N. Table of Material, Expand, Collapse When considering Medigap prepares, you may additionally check out regarding Medicare Advantage plans Called Medicare Component C.

Medicare supplement insurance, insurance policy the other hand, is an addition to enhancement existing Original Medicare initial. Bear in mind that Medigap plans just can be integrated with Original Medicare and also not Medicare Advantage. Medigap plans are standard and also recognized by letters, and also must adhere to government and also state standards. Usual Medigap protections include: This is an out-of-pocket expense that clients must pay each time they obtain healthcare or a medical item, such as a prescription.

This is the percent of the expense of a solution that you share with Medicare. How does Medigap works. With Component B, Medicare generally pays 80% and the individual pays 20%. This is the quantity of money the individual must pay out of pocket for medical care before Medicare begins paying for the expenses. With Component A, there's an insurance deductible that applies to each benefit period for inpatient care in a medical facility setting.

The Best Guide To Medigap Benefits

If you need healthcare services while taking a trip exterior of the United States, it is essential to understand that Original Medicare does not cover emergency health care solutions or supplies outside of the united state Nevertheless, there are some points that Medicare supplement insurance policy generally does not cover, such as vision or dental treatment, spectacles, hearing help, private-duty nursing, or lasting care.

Medigap prepares could aid you decrease your out-of-pocket healthcare expenditures so you can obtain economical treatment for comprehensive medical care throughout your retirement years. Medicare supplement plans might not be best for every scenario, however recognizing your alternatives will help you choose whether this type of insurance coverage might assist you manage medical care expenses.

Journalist Philip Moeller is right here to give the solutions you require on aging and retirement. His regular column, "Ask Phil," intends to aid older Americans as well more as their families by addressing their wellness care as well as financial questions.

What Does Medigap Do?

The largest space is that Part B of Medicare pays just 80 percent of covered expenses. Most most likely, even more people would acquire Medigap strategies if they might afford the month-to-month costs. Virtually two-thirds of Medicare enrollees have fundamental Medicare, with about 35 percent of enrollees instead picking Medicare Benefit strategies.

Unlike various other private Medicare insurance coverage plans, Medigap plans are regulated by the states. And also while the particular protection in the 11 different kinds of strategies are determined by federal rules, the costs as well as accessibility of the plans depend on state policies. Federal policies do supply assured problem rights for Medigap buyers when they are brand-new to Medicare and also in some conditions when they change between Medicare Advantage and also basic Medicare.

Nevertheless, once the six-month period of government mandated civil liberties has actually passed, state rules take control of determining the civil liberties individuals have if they desire to purchase Homepage brand-new Medigap strategies. Right here, the Kaiser table of state-by-state rules is very useful. It ought to be a required stop for anybody believing concerning the duty of Medigap in their Medicare strategies.

Little Known Questions About Medigap Benefits.

I have actually not seen hard data on such conversion experiences, and also on a regular basis tell readers to evaluate the marketplace for new plans in their state before they change right into or out of a read what he said Medigap plan throughout open enrollment. I suspect that anxiety of a possible trouble makes lots of Medigap insurance policy holders resistant to transform.

A Medicare Select policy is a Medicare Supplement plan (Plan A with N) that conditions the payment of advantages, in whole or partially, on the usage of network carriers. Network service providers are suppliers of health care which have gotten in right into a written contract with an insurer to offer advantages under a Medicare Select plan.